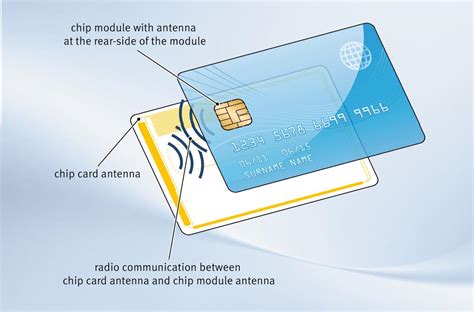

smart card and electronic payment system Used to make payments or to carry easily scannable information, smart cards are designed with an integrated chip built into the system. The chip is often embedded directly into the card and connects to a smart card reader either through wireless connectivity or physical contact.

As long as your gateway is compatible with OSDP, you have a wide range of options. You can .

0 · what constitutes a smart card

1 · smart cards used at banks

2 · smart card manufacturers

3 · smart card in banking

4 · smart card identification

5 · overview of smart card

6 · memory based smart card

7 · different types of smart cards

Aside from the Joy-Cons, the Switch Pro Controller is the only wireless option .

What is an Electronic Payment System? Electronic Payment System allows people to make online payments for their purchases of goods and services without the physical transfer of cash and cheques, irrespective of .

xiaomi mi band 7 nfc google pay

As a National eID card, smart health card, residence permit, or electronic passport, smart card technology offers more robust identification and authentication tools for both authorities' and citizens' benefits. What is an Electronic Payment System? Electronic Payment System allows people to make online payments for their purchases of goods and services without the physical transfer of cash and cheques, irrespective of time and location.A smart card is a physical card that has an embedded integrated chip that acts as a security token. Smart cards are typically the same size as a driver's license or credit card and can be made out of metal or plastic.

A smart card is a physical card that has a built-in memory chip, allowing it to transfer data electronically. Credit cards, SIM cards, and certain ID cards are all examples of smart cards. Smart cards can maintain all of their necessary functions and details without having to connect to any external databases thanks to their integrated circuits. .Used to make payments or to carry easily scannable information, smart cards are designed with an integrated chip built into the system. The chip is often embedded directly into the card and connects to a smart card reader either through wireless connectivity or physical contact.A smart card (SC), chip card, or integrated circuit card (ICC or IC card), is a card used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) chip. [1] . Many smart cards include a pattern of metal contacts to electrically connect to the internal chip.

Payment processing systems cater to various types of transactions, including credit and debit cards, electronic funds transfers (EFTs), automated clearing house (ACH) transfers, mobile payments, digital wallets, and cryptocurrencies.

Common Methods of E-Payment. How Do Electronic Payment Systems Work? Are Electronic Payment Systems Secure? Key Takeaways. What Is an Electronic Payment System? Simply put, electronic payments allow customers to pay for goods and services electronically. This is without the use of checks or cash.

Our review focused on the importance of trust, security measures and technologies that govern how transactions occur in contactless payment cards and NFC-enabled mobile wallets. We will also investigate EMV and ISO standards for contactless payment and highlight their limitations in improving the security and privacy of contactless payments.

A smart card is a credit card-sized card that contains a microprocessor and can be used to store and process data securely. It has an embedded chip that enables it to carry out cryptographic functions and authenticate the cardholder. This is different from a regular credit card that stores only the cardholder's information in a magnetic stripe.As a National eID card, smart health card, residence permit, or electronic passport, smart card technology offers more robust identification and authentication tools for both authorities' and citizens' benefits. What is an Electronic Payment System? Electronic Payment System allows people to make online payments for their purchases of goods and services without the physical transfer of cash and cheques, irrespective of time and location.

A smart card is a physical card that has an embedded integrated chip that acts as a security token. Smart cards are typically the same size as a driver's license or credit card and can be made out of metal or plastic.A smart card is a physical card that has a built-in memory chip, allowing it to transfer data electronically. Credit cards, SIM cards, and certain ID cards are all examples of smart cards. Smart cards can maintain all of their necessary functions and details without having to connect to any external databases thanks to their integrated circuits. .

Used to make payments or to carry easily scannable information, smart cards are designed with an integrated chip built into the system. The chip is often embedded directly into the card and connects to a smart card reader either through wireless connectivity or physical contact.A smart card (SC), chip card, or integrated circuit card (ICC or IC card), is a card used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) chip. [1] . Many smart cards include a pattern of metal contacts to electrically connect to the internal chip. Payment processing systems cater to various types of transactions, including credit and debit cards, electronic funds transfers (EFTs), automated clearing house (ACH) transfers, mobile payments, digital wallets, and cryptocurrencies. Common Methods of E-Payment. How Do Electronic Payment Systems Work? Are Electronic Payment Systems Secure? Key Takeaways. What Is an Electronic Payment System? Simply put, electronic payments allow customers to pay for goods and services electronically. This is without the use of checks or cash.

Our review focused on the importance of trust, security measures and technologies that govern how transactions occur in contactless payment cards and NFC-enabled mobile wallets. We will also investigate EMV and ISO standards for contactless payment and highlight their limitations in improving the security and privacy of contactless payments.

what constitutes a smart card

smart cards used at banks

TIGER TALK. Thursdays at 6 p.m. CT. Hosted by Brad Law and the Voice of the Tigers, Andy Burcham, weekly guests will include head football coach Hugh Freeze in the fall .

smart card and electronic payment system|smart card in banking